After a lot of debate, threat and counter threat on Wednesday Russia has said it will resume participation in the grain deal. This was following the news that Russia had withdrawn from the UN Ukrainian export deal on Saturday in response to the drone attack in Crimea.

As a result the grain and oilseed prices jumped on the news of Putin’s withdrawal. K feed wheat futures followed global movements on the back of this news, with the May-23 contract up £9.45/t on Monday, to close at £289.45/t. The highest close for the contract in over two weeks. However, when the news came that they will resume participation on Wednesday after receiving written guarantees from Kyiv not to use the corridor for military operations against Russia.

As a result, global grain prices and as such UK feed wheat prices are falling against Tuseday’s close. By Wednesday, UK feed wheat futures (May-23) were trading at £279.00/t (13:30) down £10.25/t. Nov-23 prices have fallen £10.05/t to trade at £260.00/t (13:30).

Key market driver

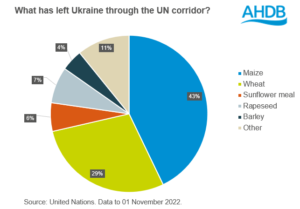

Megan Hesketh, senior analyst Arable AHDB, says: “News on Ukrainian exports remains the key market driver across markets, how tight is global grain and oilseed supply? Since the establishment of the deal in July, 43% of total cargo shipped from Ukraine has been maize and 29% wheat. As such, a large proportion of wheat is still tied up in the Black Sea region, meaning we are seeing volatility especially in wheat markets.

Even though Russia has resumed participation in the UN corridor now, markets still await news on whether the deal will be renewed on expiry in just over two weeks’ time. It is believed Putin will use the extension of the deal as leverage in the G20 summit in Indonesia on 15/16 November. Putin too is concerned about Russian grain and fertiliser exports too, so could use this in negotiations. As we hear news, expect volatility in grain and oilseed prices to continue.”

Even though Russia has resumed participation in the UN corridor now, markets still await news on whether the deal will be renewed on expiry in just over two weeks’ time. It is believed Putin will use the extension of the deal as leverage in the G20 summit in Indonesia on 15/16 November. Putin too is concerned about Russian grain and fertiliser exports too, so could use this in negotiations. As we hear news, expect volatility in grain and oilseed prices to continue.”

Another factor in the differing domestic movement this week to global contracts is the strengthening of sterling against the euro (+0.19%) and the US dollar (0.12%).

Meanwhile, this week saw USDA’s first crop conditions for the US planted winter wheat crops. It suggested that 28% was rated as good to excellent, compared to 45% this time last year. This is due to some exceptionally dry weather this year.